Earlier this year, we received a frustrated email from a reader. He wrote: “Once and for all, I would like to know exactly what ACV is. You hear several definitions depending on the site you visit. Then I would like to know how to calculate it, what it tells me, and why suppliers should care.” A great list of questions about an important CPG metric!

Earlier this year, we received a frustrated email from a reader. He wrote: “Once and for all, I would like to know exactly what ACV is. You hear several definitions depending on the site you visit. Then I would like to know how to calculate it, what it tells me, and why suppliers should care.” A great list of questions about an important CPG metric!

First, what is ACV? ACV stands for All Commodity Volume. It is total retail dollar sales for an *entire* store across all products and categories. In the world of CPG, it’s a common way to measure the size of a store or retailer. Rather than a measure of physical size, like square footage, ACV reflects how much total business is done in that outlet.

Why would a supplier of a specific product care about overall retailer ACV? If you are looking to expand distribution, ACV can help you prioritize opportunities. Generally speaking, the bigger the retailer’s volume, the bigger the sales potential for your product. And ACV trends will give you perspective on the business health and growth potential for that retailer.

One source for data on retailer ACV is industry trade publications and company annual reports. For example, here’s a Progressive Grocer ranking of the top 50 supermarket chains which includes information on total retail sales.

If you purchase a Nielsen/IRI database, you can calculate total retailer ACV across all products (even if you are buying data only for one specific product category). I wrote a post on how to back into that ACV estimate.

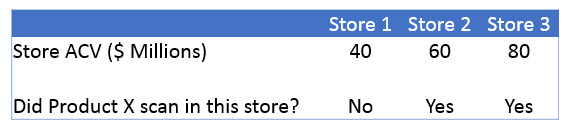

So that’s what exactly what ACV is. Seems pretty straightforward, right? Why would my reader feel confused by seemingly different definitions? Probably because ACV is also an *input* into the most commonly used syndicated distribution measure, called “% ACV” aka “ACV Weighted Distribution”. Sometimes, when people use the term “ACV” they really mean “% ACV”. We’ve written buckets of posts about % ACV (start with this one) so I’m not going into detail on this most important of distribution measures. But I do want to illustrate here how % ACV is calculated, how it relates to raw ACV, and what it means to “weight” distribution. Here is a simple example of a market made up of 3 stores:

How big is this market overall?

Total Market ACV = 40 + 60 + 80 = $180 Million

What is distribution for Product X? There are two answers, depending on whether you are looking at unweighted or at weighted distribution:

Unweighted distribution = % of stores selling = 2 ÷ 3 = 67%

ACV weighted distribution = % ACV = (60 + 80) ÷ 180 = 78%

% ACV distribution is calculated by looking at total ACV in the stores where a product scanned, divided by total ACV for the market. Because Product X sold in the two larger stores in this three store market, its % ACV distribution is higher than its % of stores selling.

Why is % ACV considered the more insightful measure of distribution for your product? Because it represents your exposure to consumer spending. Sales potential in a high ACV store is theoretically better for every product, including yours. So you want to give your product more distribution “credit” for selling in those higher ACV stores.

Because ACV is used to calculate % ACV Distribution, you will see the term “ACV” in other measures as well (promotion measures and velocity measures). It all comes back to using ACV to weight distribution, though, no matter what the measure. So if you understand that concept, then you understand everything you need to know about how ACV is used in syndicated data.

I’ll end on this nerdy side note that may be of interest to some data obsessed readers: when Nielsen and IRI calculate the ACV that they use for weighting, they exclude some departments like lottery and pharmacy and gasoline because not all stores have those departments. Because of that, Nielsen/IRI ACV for a retailer may not match total retailer sales numbers reported in annual reports or other sources. Contact your data supplier for their specific list of departments included in/excluded from their ACV numbers. Note that ACV is usually updated on an annual basis.

Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles about once a month. We will not share your email address with anyone.

Love your insights! Great articles and so informative, thank you! I have question, hopefully you’ll have some suggestions….Is it possible to get free sample syndicated/retail data for a job interview? For example, I’d like to know how the brand Zarbee’s is performing prior to my interview. Ideally, I’d like to impress them with my research and possibly provide some insight. Do you have any suggestions or recommendations for obtaining sample data under the circumstances? Thank you.

Hi Violet,

Thanks for your positive feedback on our articles! Kudos for making the effort to do extra thinking and prep for your interviews.

Raw data is not typically available for free from IRI and Nielsen. They do make some research datasets available to some educational institutions – if you are connected to a university, you might want to ask about that. Some institutions also subscribe to research reports from companies that incorporate IRI and Nielsen data. For example, I had one reader that was able to obtain Mintel Oxygen reports from his university library.

You might also check the Nielsen/IRI websites for press releases, webinars, etc. on topics related to your brand or (more likely to be found) your category of interest. Since you mentioned Zarbees, you might also investigate what is available publicly from SPINS – they are the IRI/Nielsen of the Natural/Organic channel.

Trade publications will often site Nielsen/IRI/SPINS data in their stories. So a google search might turn up something – again, sometimes looking for a big story about the category, rather than the brand, might yield the kind of feature piece that would be more likely to include data.

Hope this helps!

This is an awesome explanation of how to calculate ACVD.

I am stuck with a small problem though. I wish you could help me with this. I don’t have the data at store level (so don’t know store level ACV). However, I do have market level data (markets defined by Nielsen and the data is aggregated to weekly level). So if I were to calculate the ACVD aggregated to 4 weeks, how should we go about it?

Sample data

UPC,Period,Market,ACVD

101,01-01-2016,xAOC,43.5

101,08-01-2016,xAOC,34.2

101,15-01-2016,xAOC,75.3

101,22-01-2016,xAOC,64.3

I want to aggregate the data to 4-weeks and calculate the ACVD.

UPC,Period,Market,ACVD

101,4 W/E 22-01-2016, xAOC, ??

PS: It’s easy to add DollarSales but not sure what to do with ACVD?

Thanks

When aggregating ACV Distribution, you can either take the average or the max for the individual weeks in the period. There is no way to truly calculate the 4 week ACV from the individual weeks so those are your two options. I usually use average. Either way, make sure you label your data clearly so everyone understands what they are looking at.

Dear Sally,

I enjoy how thoroughly you are covering topics across all aspects of syndicated data!

As I read a couple pieces about ACV, I’m still not entirely sure what sales volume it refers to. You said “…it’s a common way to measure the size of a store or retailer” which seems to refer to a store/retailer as a single location. For example, does the data give the sales volume of the ONE location of Albertson’s on 123 Main Street? Or, does the data give the sales volume of all Albertson’s locations in a certain city/area/region?

A very basic question, but I appreciate your time to answer.

Chris

Chris,

Within a Nielsen/IRI database, ACV will be provided (or can be calculated) for the combined set of stores in a particular “market”. The “market” could be the corporate level for a retailer (e.g. Total Albertsons Corporate), a banner or division for a retailer (e.g. Albertsons Shaws), or a geographic break for a retailer (e.g. Albertsons So Cal). The “market” could also be an entire metro area, including all retailers, like “Jacksonville”. You would be unlikely to see ACV data for individual stores unless you received some type of store level report which, in my experience, is uncommon.

Best,

Sally

Dear Sally,

I have a question about the %ACV calculation *categories*.

For example:

A new plant-based yogurt company want to expand its distribution in the U.S. New England area, which of the following approaches is more cost-efficient and insightful to prioritize opportunities in the real business word? (I am a master student working on Nielsen/IRI data in the academic setting)

Approach 1:

Only calculate the %ACV among the refrigerated milk category rather than the “total retail dollar sales for an *entire* store across all products and categories”, and then choose the distributors they want to work with.

Approach 2: Step-by-step.

1. Calculate the entire %ACV (the common practice)

2. Narrow down the categories into refrigerated milk and other plant-based/organic/health-fortified foods. Then calculate the narrower %ACV.

3. Investigate the demographic information within New England area to estimate the exposure to consumer spending (like lactose intolerance, vegan dietary,etc)

4. Finally, pick not only the outlets with high %ACV but smaller grocery stores shows promising market performance.

I may have lots of mistakes and hope you can correct my understanding. Thank you!

Rachel

Hi Rachel,

Generally taking some type of strategic approach (as in your Approach 2) is going to be better than just going after the biggest retailers (as in your Approach 1).

Some other factors to consider in refining Approach 2:

1) How much capacity does the company have to produce the product? Are some retailers going to be too big to approach?

2) For the retailers you are approaching, which ones are interested in taking local products and how can you leverage that?

3) What is each retailer’s strategy/mission as it relates to what your new product offers (and your product category in general).

Thank you Sally! That’s really helpful.

I forget to think from the supply side (capacity) and how to collaborate with retail customers is very important for manufacturers (assortment, trade marketing, planogram, etc).

– Rachel

Hi Sally,

What are your thoughts on why is %ACV not expressed as a percentage? I wonder if that is not part of what confuses folks on the measure.

Also, wanted to ask about a recent measure SPINS published, Average Units Sold per Store per Week. Wanted to know your thoughts on using this measure versus other velocity measures?

Thanks for all you do! Craig

Craig,

1) Are you referred to the fact that the %ACV will be expressed (in Nielsen/IRI raw data) as 75.4 instead of .754 or 75.4%? If so, then I personally do find that annoying because I always have to reformat it in my reports. So I wish they would include a % sign or store the data as a decimal. But perhaps they have their valid reasons – I’ve never asked. If that’s not what you meant, then please clarify your question.

2) Units per Store per Week is a very common old school velocity measure. I prefer measures weighted by ACV so I personally would choose a different measure if I had a choice. I don’t use SPINS data much so don’t know if they have a Units per $MM type velocity like IRI/Nielsen. If you haven’t read my post about velocity measures you might find that useful – this is a long discussion of various options.

Hi Sally,

I am new to CPG and was wondering how to read ACV Weighted. In your example, it says ACV weighted distribution is 78%. Does this read as your product is scanning in 78% of stores?

ACV is similar to, but not the same as, % of stores. %ACV takes into account the relative size of the stores where you have distribution – bigger stores (with more shoppers) are better. Take a look at this post on ACV and then this one. You’ll see many posts on distribution on the CPG Data Tip Sheet – it’s an important (and confusing) topic for CPG companies!

Are displays in Walmart’s seasonal aisle counted as incremental displays by Nielsen

I believe it would depend on whether the seasonal aisle was a secondary location. If not, I don’t believe it would be counted as a display. However, you should contact Nielsen directly for a definitive answer.

Is there a commonly recgonized %ACV range that a product could have within a national look at the market (MULO/xAOC or Total US Food) that would be considered a “Benchmark” signifiying a “national brand?”

For instance, in my category, no competitor has distribution in all 50 states, including our own. Our %ACV is about 40% and we’re the highest branded product. Private label, however, enjoys an 85% %ACV. National brands related to our category (i.e. we don’t directly compete against them, but products are similar) have %ACVs of over 95%.

Is there a good way of judging on whether or not an item is considered a “national brand” via %ACV?

I don’t think there is a commonly recognized number. To be considered a national brand, the key thing would be availability in at least one major retailer in markets all across the country. In other words, the geographic reach would be more important than hitting a specific ACV target. That complete geographic reach, combined with a fairly high ACV level (say 60% or more) would be a good criteria to use for “national brand”.

As you point out, though, there are categories (like yours?) where it’s not a relevant term. There aren’t any national brands. Private label would never be a national brand since it’s made up of many localized brands all rolled together.

Thanks for your reply! That all makes sense to me – one question though. By ‘Geographic reach’ how might we determine this? My initial guess would be to evaluate our BDI across the Census or DMA geographies across the US and identify the gaps where BDI is underindexing and determine if our reach is contiguous, or gapped.

Would you do the same? Is there a better way?

If you have access to a database, you can pull the % ACV distribution by market. I think syndicated databases all have the 50 Nielsen markets (somewhat bigger than DMAs), which are basically major metro areas. That would show the breadth of distribution in each market and you could see where the brand is more and less available. That is most likely highly correlated with BDI. Hope that helps!

ACV is also a great way of coordinating decisions between shelf display planogramming/micro space planning and whole store retail floor planning.

Janelle – Would you be interested in writing a guest post about that? If so, please contact us here and we can discuss further.

I want to understand the “amount” or % of distribution on promotion for my product. IRI/Nielsen uses Any Promo %ACV while SPINS uses Avg % ACV, Any Promo — within the context of this question, let’s refer to these Facts as Distribution on Promo.

1) Does Distribution on Promo tell me the % of stores (weighted by size) that scanned my product where a promotion was present?

2) If my goal is to determine the level of trade participation in an event, is this the appropriate measure to look at?

3) Say your goal is to determine the level of trade participation in an event, how would you approach answering this question?

1) yes, and promotion is defined as a retailer feature, an in-store display, or a price reduction of at least 5% (calculated based on scanned price versus base price)

2) yes

3) if you have specific goals for amount of display or feature ads, you would want to widen your analysis and incorporate other measures (like % ACV Any Display, % of ACV Any Feature, % of ACV Feature and Display, etc).

Hi Sally and Robin,

I’ve got a doubt. How to aggregate “% ACV Any Display” column across different weeks? Let’s Say If I am pulling data for latest 4 weeks, and I want to aggregate the data to a category level, what is the Aggregation logic for the “%ACV Any Display” and similar ACV columns in IRI.

Thank You !

Please see this Glossary entry on non-additive measures and the comments, too. Unfortunately you cannot aggregate across items or brands to get %ACV Any Display (or any %ACV measure) for the category. The only correct way is to pull the data at the category level. This is because many different items could be on display someplace in any given week so it would be double counting if you just add up the %ACV Display for all the items. For many categories there is some brand or item on display every week in most retailers so it’s not unusual to see 100% ACV Display at the category level. Examples are CSD (carbonated beverages), cereal, coffee, salty snacks, etc. I am happy to discuss this further and look at exactly hat you’re trying to do and why – you can fill out this Contact form and I’ll get back to you to set up a time to meet.

Hi, Clear about Numeric and ACV Weighted Distribution. I have a question about TDP (Target Distribution Point) where how many products from your portfolio you have placed in a particular market comes into the picture. Can you through some light on this?

TDP generally stands for Total Distribution Points. We have a whole post on that topic:

https://www.cpgdatainsights.com/distribution/total-distribution-points-post/