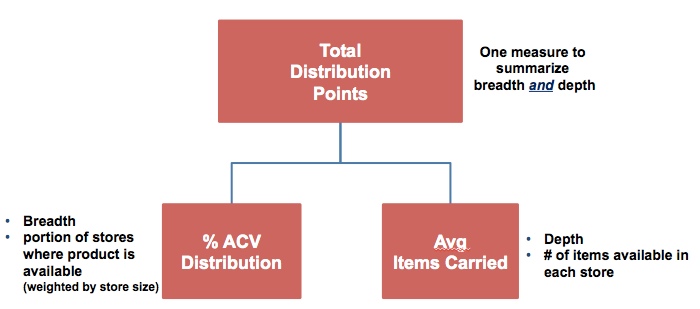

We have already discussed 2 key measures relating to distribution: % ACV Distribution and Average Items Carried. For product aggregations above the item level, % ACV Distribution provides a measure of distribution breadth and Average Items Carries covers depth. But what if you want to have one measure that summarizes distribution, taking into account both breadth and depth of distribution? Total Distribution Points (TDP) is what you’re looking for! (Note that it is sometimes called Total Points of Distribution, or TPD. I will refer to it as TDP throughout this post.)

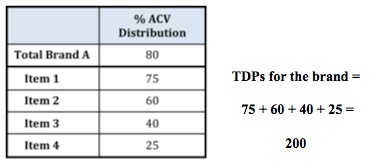

Luckily, TDP is on most IRI/Nielsen databases, although it is very easy to calculate if necessary. TDP is the sum of the % ACV Distribution of all items in a brand, segment, category or any other aggregation of products. Here is an example of one brand’s TDPs and how that relates to % ACV Distribution and Average Items Carried. Let’s assume that Brand A is made up of 4 items. The table below shows the % ACV Distribution of the overall brand and each of its 4 individual items. Brand TDPs = 200.

You can see that if a brand has more items and/or each of those items is in higher distribution, the TDPs go up.

Note that the brand % ACV is not used to determine TDPs. TDPs are always calculated at the item level; including brand % ACV in your TDP calculation would be double counting.

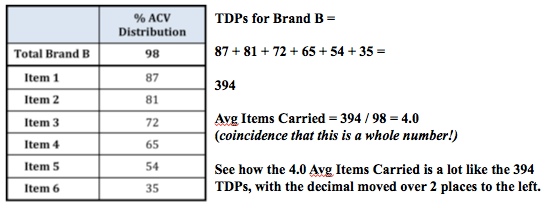

For some products, TDPs and Average Items Carried will be redundant. If your brand is in very high distribution (95% or more), then TDPs are essentially equivalent to Avg Items Carried – just move the decimal point over 2 places, as in this example:

Bottom Line: When you need one measure to summarize distribution, use TDP. It takes into account how widely your products are available and how many items are available. If your brand is in almost total distribution, you can use either measure. In my experience, Average Items Carried is the better one to use since your audience is likely to find it more intuitive. It’s easier to wrap your head around the number of items carried per store than a more abstract number like Total Distribution Points.

Have other questions about retail distribution measures? Leave a comment below or or contact us and we’ll do our best to answer it!

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles twice a month. We will not share your email address with anyone.

Can you tell me how to calculate any specific Brand’s % ACV Distribution?

Krishna,

If you have distribution at the individual sku level but don’t have distribution for the total brand, there is no way to calculate % ACV Distribution for the brand. % ACV Distribution is a non-additive fact. But here are a couple of suggestions:

1) Look at Total Points of Distribution (described by Robin in this article) at the brand level. This can be done by adding up the individual sku level distribution numbers. It’s not the same as % ACV distribution but it is something you can look at over time, across markets, and across brands.

2) If any of the individual sku distribution numbers are close to 100%, you can safely assume that the brand distribution is close to 100%. In other words, brand distribution must be *at least* as high as its best sku.

Hi Sally,

It looks like for calculating TDP, ACV Max would be used, as opposed to ACV Average, correct?

Love the articles!

When using the % ACV measure, the choice of ACV Max or ACV Average depends on which you think is the most accurate measure of your distribution. And that judgement applies when you are using TDP as well (since TDP is a function of % ACV). So if you have a slow moving category with stable distribution and minimal out of stocks, Max is probably best. Or if you have a new product that is building distribution, Max also makes sense. If you have a quick moving category with product availability or out of stock issues, then Avg is likely a fairer measure of your true distribution.

Any time you are thinking about any measure related to % ACV, ask yourself this question: “What is the fairest representation of my actual on shelf presence, given my particular business issue and product?”

Hi Robin/Sally

Really great blog here, very insightful!

I’m based in the UK and have never heard TDPs mentioned, however we do have something called cumulative distribution – is this the same thing?

Best regards

MT

I am not familiar with the term “Cumulative Distribution,” but it may be the same as TDPs. You can figure out of they are the same by doing the TDP calculation manually and comparing the result.

An alternate definition for Cumulative Distribution could be related to the time dimension. Here’s an example: %ACV Distribution for a 52-week period is 45% but Cumulative Distribution for that same 52-week period is 72%. This would mean that the “regular” %ACV Distribution measure is the average of all the individual weeks but the Cumulative Distribution is the %ACV in which the product EVER sold over those 52 weeks. My example would happen for a new product – avg weekly distribution over the course of its first year could be 45% but over that first year it eventually sold in 72%.

If you pull “regular” %ACV Distribution and Cumulative Distribution for a 52-week period, you should be able to tell which of these is the correct interpretation. I hope this helps!

Loved this post! Prior to reading this, I’ve been using Average Number of Items as the primary measure of breadth and depth of distribution. Now I find myself creating the aggregate for TDP for a more complete understanding of the true number of points of distribution. Much more useful for me to use the TDP results to truly understand velocity at the Brand, Segment or Category level.

Hi Sally,

Does the %ACV matter if it is Max or Avg when making these calculations? Or are you saying %ACV Distribution is a fact?

Thanks,

Bob

The ACV measure available depends on which tool you have from IRI or Nielsen. If you are using the web version from either supplier (IRI Market Advantage or Nielsen Answers), I’m pretty sure there is one key measure for ACV Distribution. That’s because the ACV-related measures are always calculated from the lowest of detail (UPC and weekly). Because you’re asking about Max or Avg ACV, I’m guessing you are on one of the Excel-based tools, IRI XLerate or Nielsen NITRO.

Max ACV gives you the highest ACV for any of the items that make up the product total you are looking at and for the highest week in the period. Avg ACV gives the average of the items and weeks. So…if the product total you are looking at is pretty stable (ie – an entire category or segment or an existing brand), then both ACV measures will be very similar. If you’re looking at a new brand or segment then it’s probably best to use Max ACV, since using Avg would take the average of all the weeks of the introduction while distribution was still building.

Hope this helps!

Thanks for the great article! As I’m new to this industry, I have a doubt on aggregating ACVs. Say for example, I have 4 products/ SKUs under each product groups and I plan to analyse at the group level. I have data only on SKU level ACVs (not at the group level). Now I need to calculate the ACV at the group level. One method I thought of was to take the weighted average of the products’ ACVs based on the volume of sales that were made during the time period. And now when I come across this term TDP, I get a doubt whether to use this TDP or the weighted average of ACVs. Can you please explain me which is a better measure?

As is so often the case with data analysis, the choice of measures depends on what question you are trying to answer.

TDP essentially tells you the average number of SKU’s carried per store in the market. It’s at least saying something about the group of products in aggregate.

Your weighted measure tells you the individual SKU distribution achieved by your average SKU. It’s really not saying anything about the group of products in aggregate.

Neither measure will tell you the %ACV that carries *something* from your line of products. That’s not possible with the data you have in hand. However, you do know that the % ACV for the whole group can’t be less than the % ACV from the item in your line with the best distribution. So if one of your products has close to 100% distribution, then you can assume that product group distribution is also close to 100%.

Hello, thanks a lot for your articles, they are so useful and straight forward!

Just one question on TDP: Which time frame would you advise to use?

The most common time periods to look at TDPs for are probably 4-week and 12-week. Sometimes you may want took at a longer timeframe and occasionally weekly TDPs can be helpful. If you are most concerned to see what your current distribution is, then I recommend looking at the most recent 4-week period. It essentially eliminates the possible understatement that can happen for slow-moving items that may not sell in every store every week. (You’ll see that the %ACV Distribution and TDPs usually increase the longer the period is. That’s because items sell in more places over a whole year than in an individual week.)

If you want to see trends in distribution over time, you can look at weekly TDPs in a line graph. This will show if your distribution is generally growing, declining or flat. You may also see some seasonality in distribution this way, as retailers carry more items in certain categories at specific times of the year (for example, more kinds of candy in October or more kinds of sunscreen in the summer).

Hope this helps!

Hi and thank you for the great article!

Is it possible to look at aggregate TDPs across custom aggregated IRI markets? Let’s say I’m looking at 4 markets aggregated and want to know a brand’s TDP in that new aggregate look; is this a possibility, or must TDPs be looked at only in individual markets?

Yes, TDP is an additive fact like dollars! That’s one of the things that makes it so useful. You can create a value for TDP from any combination of markets or periods or products. Just remember, though, that the more markets you put in your aggregate, the higher the TDP value will be. So you would need to take care when comparing TDP across custom aggregates. For example, if you have 4 markets in one aggregate and 5 markets in another, the TDP is likely to be higher in the second aggregate simply because it includes more markets.

Hi,

I am looking at a particular group of core upc’s and want to see what the total %ACV of just these 20 UPC’s would be for a particular retailer. I have %ACV, Sales Per Point of Distribution ($), and Dollar Sales. I want to add up the Dollar Sales/SPPD to get the %ACV of the 20 core upc’s.

However, when I add up the SPPD for all of the UPC’s in the total brand the UPC total SPPD ($) are greater than the brand total SPPD$ that is delivered out of the Nielsen database. The total SPPD $ rolled up at upc level are about 47% higher in SPPD$ than the brand total that is delivered from the db.

Can you help me understand?

Good question!

You’re trying to determine what the %ACV Distribution is for a group of 20 UPCs, but those 20 UPCs are only a subset of the total brand. Unfortunately you cannot get exactly what you need, but here are some key points:

– The %ACV Distribution for the 20 UPCs (i.e. % ACV selling any of the 20 items) will most likely be something somewhat higher than the %ACV of the highest UPC.

– Think of SPPD $ for the brand total like a weighted average of SPPD $ all the UPCs that make up the brand, or the sppd $ for the average UPC in the brand.

– You are correct that for a given UPC or subtotal on the DB that if you know 2 of the following facts you can back into the 3rd one: %ACV, Sales Per Point of Distribution ($), and Dollar Sales. The key for aggregates is that they must be on your DB, and not calculated.

Based on the data you sent me, the %ACV Distribution for the 20 UPCs has to be something something between 89 (the highest distribution for any UPC) and 92 (the distribution for the whole brand). You could split the difference and call it 90.5 then use that as the denominator for the SPPD calculation.

Hope that helps!

Hi, Firstly Thanks for the great article. Very Useful.

My question is “Is it right to say the highest TDP for a single SKU in a single Market, for 52 weeks will be 5200”?

Thanks for the question! The TDP for a single SKU in any geography is 100, for any period. At the SKU level, TDP is the same as %ACV Distribution so the highest possible value is 100. For any product aggregate bigger than a single SKU, there is no maximum, except for the total number of SKUs * 100 – that would mean that all SKUs are in 100% ACV distribution. The only way that the length of the period affects TDPs is that the value can be slightly higher for longer time periods. For example, the TDP (or distribution) for a SKU might be 87 in a 4-week period but 95 in a 52-week period. The less frequently that shoppers purchase something, the bigger the difference will be in the values for 4 weeks vs. 52 weeks.

Hope that helps!

What is Numeric Distribution Max? How to read these figures

Based on your question, it seems like you are looking at data from outside the US since we usually don’t see the term “Numeric Distribution.” I’m not sure if that means a % of stores or % of ACV or something else. Does the number range between 0 and 100? The “Max” designation means the measure is the maximum (as opposed to average) distribution achieved during the period. For example, max distribution for an item over a 52-week period may be 85 but the average distribution over those 52 weeks could be only 68%. Said another way, over the course of the entire 52-week period, the sold someplace in 85% but in an average week it sold in 68%. The longer the time period, the more different the max and avg distribution are likely to be.

Hope that helps!

it is the % of Stores (where the item or brand or manufacturer is present). so if the brand is present in 600 stores out of 1000 stores (for that channel) for example, then it has a 60% numerical distribution (irrelevant of how well the stores are performing).

If it only says Numeric or Numerical Distribution: It is for all stores (ie the ones selling the products, or the ones simply carrying the product during the period)).

but if it says “selling numeric Distribution”, it is for the stores who sold the product during the period (and not just the ones who carried it)

the counterpart of % of ACV, would be Weighted distribution (WD), but most of the time WD is at Category level instead of all commodity volume.

Thanks for the clarification! (FYI, Readers – Ludivine worked for Nielsen servicing global clients so she knows this stuff!)

Hi, Firstly Thanks for the great article. Very Useful.

LUDIVINE, would you please explain the WTD selling distrbution by the same way you did with “selling numeric Distribution”,

Numerical Distribution Maximum theoreticaly will be 100%, meaning for example out of 10 stores 10 have your product.

Other term that I hear for ND is Trade Penetration Percent, so it might be therm used in US.

If I say that the Total Distributions Points increased by 10% versus prior year, what does this mean?

You can think of it as overall retail presence in the market has increased by 10%. At the item level, TDP is the same as %ACV so a 10% in TDPs means the item is in more stores and those additional stores represent 10% of the ACV. For larger product aggregates (like brands), a 10% increase in TDPs could come from:

1. the brand getting into additional stores that it was not in at all and they represent 10% of the ACV

2. more items getting into stores that the brand was already in

3. some combination of these two (most common)

Hope this helps!

hi there,

This blog is so helpful.

Say that I have item ACV data for a market (ex US food over $2m) and I also have item ACV data at the account level.

I know that it is accurate to sum the ACVs of each item in the market (US Food) and state this as the total distribution points in that market. Is it defensible to sum the item ACVs in each account (Albertsons, HEB etc), and then sum the TDPs of those accounts as a representation of distribution? Essentially, someone wants me to use the much larger number yielded from the second approach, rather than the former, which I feel is more accurate.

Thanks!

While I like your creativity in coming up with another distribution measure, I do not recommend what you describe. If you sum the TDPs across retailers, then 400 TDPs in Kroger would get the same “credit” as 400 TDPs in a much smaller account, like HEB. You are correct that summing the %ACV of all items within a market is the most accurate and robust measure.

If a chain has 100 Stores and 5 SKUS are authorized do I have 500 potential points of distribution?

Regardless of how many stores are in the chain, if you have 5 items authorized then the maximum potential TDPs would be 500 since the measure is based on ACV and not number of stores. TDPs of 500 means that 5 items are in 100% distribution. You may want to take a look at this post about Distribution which explains more about why “Authorized” and “In Distribution” are not the same thing as far as the database is concerned (https://www.cpgdatainsights.com/distribution/2nd-most-important-part1/). An item must actually scan to be considered in distribution. In your scenario, if all 100 stores are the same size (in terms of overall sales) and all 5 items scanned during the period, then, yes, you would have 500 TDPs. In real life, both of those things are rarely, if ever, true. Even within a chain there are usually stores of different sizes. Also, just because all items are authorized at the chain it doesn’t mean it is actually on the shelf in all the stores within the chain. I would guess that each of the 100 stores probably has 3 or 4 of the 5 items on shelf, although all 5 items are selling someplace within the chain.

Thanks for such a useful effort

My question is more on how to benchmark TDPs i.e. do you recommend a TDP range for Low, Medium and High performance?

Any benchmark is related to how many total items are available in your portfolio so there is no one answer for all brands. If you offer 10 items than the maximum TDPs would be 1,000 if every single store actually scanned every single item you offer (10 items x 100% ACV). If you offer 6 items, than that maximum would be 600 TDPs (6 items x 100% ACV).

If you are comparing retailers to each other for the same brand, then you could look at TDPs for Total US and say any retailer that has the national TDPs + or – maybe 20% is Medium. Any retailer with lower than 80% of the national average would be Low and higher than 120% of the national average would be High.

It is harder to fairly compare TDPs to each other across brands since they could have widely varying portfolios in terms of number of items.

Hi,

I’m trying to wrap my head around something regarding TDP.

So I’m looking at one particular SKU, and I need to know TDP in each syndicated area. Unfortunately, I don’t understand why xAOC only has 77 Distribution points, but Alabama has over 100. Shouldn’t Total xAOC essentially be a combination of all distribution points? Am I misunderstanding something?

Thanks!

First, at the item level, TDP and %ACV are fundamentally the same. If a UPC has %ACV of 77% then TDP is 77. So for one item, just focus on %ACV.

Second, the TDP measure in Nielsen and IRI is a sum of %ACV for groups of products within a market. It is not a sum of %ACV across markets. xAOC distribution is a combination of all distribution points, yes, but it’s not literally a summation of all distribution points. The %ACV and TDP measures will be recalculated within each market.

I hope that helps. Please feel free to ask additional questions if I haven’t cleared it up for you.

Hi Sally,

I have been reading many of your responses to questions above and have learned a lot in a very short time reading your replies. I am however still confused with respect to TDPs at the item level. You have indicated at the item level, TDPs are essentially the same as % ACV. However, I am looking at a Nielsen based report for a retailer that shows the following:

Retailer A %ACV Reach TDP

TOTAL 93.7 278

SKU 1 93.7 75

SKU 2 83.6 55

SKU 3 75.2 44

SKU 4 82.6 30

SKU 5 71.7 40

SKU 6 65.7 34

I am trying to understand how TDPs are being calculated by SKU. Any insight you can provide is much appreciated.

Hi Robert,

It looks like the two data columns are % ACV Reach and TDP. And you are wondering why they aren’t the same number since I said that % ACV and TDP are the same at the item level?

What’s going on is that you are looking at a “reach” measure and an “average” measure. If it doesn’t say “reach” then you can assume it’s an average. And that’s what’s making them different, not the fact that one is % ACV and one is TDP.

You don’t say what the time period is but let’s say it’s 13 weeks. The % ACV Reach measure would give the product distribution credit for a store as long as it scanned in that store at any point during the 13 weeks. But the regular TDP measure would average weekly distribution for the 13 weeks. An average/regular distribution measure will pretty much always be higher than a reach measure. Robin wrote a post that talks more about the “reach” versus “average” differences: What’s With All These Similar Distribution Measures?

Hello, thank you for your site and posts. I often refer to your site to clear up any confusion about measures.

In regards to TDP: If a brand’s TDP’s are down -5.3% vs. YA, in a vacuum that would indicate that it has scanned less frequently in the time frame vs. YA; right? Now what if sales are down only -2.2% and $/$MM ACV is up +39.5%? Am I safe in assuming that with sales down less than TDPs there’s some growth unaffected by distribution? That coupled with velocity growth, can I deduce that the decline is not a function of less scans but more of a function of out of stocks?

Thank you for your time and help!

-Ali

Thanks for the kind words! Glad you find the CPG Data Tip Sheet helpful.

Let me address each of your statements/questions:

1. If TDPs are down vs. the same period a year ago it does mean that it scanned in fewer stores (or in more smaller stores), not necessarily less frequently. If the TDPs you’re looking at are based on max and not average ACV an item only has to scan once in the 52 weeks for it to count as being in distribution. The TDP number is based on where it scans, not how often.

2. In your example, sales are down and TDPs are down and velocity is up. This means that the sales decline is due to the distribution loss but that where the brand is in distribution, it is selling faster than it was last year. An increase in velocity can be a result of lower pricing, more trade merchandising, more advertising, etc.

3. You can’t tell anything about out-of-stocks vs. discontinued items from a 52-week scenario. You’d have to look at a weekly trend of %ACV by item. If the %ACV goes down and then comes back up that’s most likely OOS.

Hope that helps!

Hi Sally/Robin,

First of all thank you for your post it is very insightful.

I am interpreting an Item Ranking Nielsen report but I having some problems understanding the difference between Sales per Point Distribution and Value/Volume ROS. I would appreciate if you can explain the difference between these concepts.

This is the type of figures of the report:

Value ´000 pr wtd Dist. Pt Value ROS

Item A 62,6 2196,6

item B 42,2 1480,4

Thank you!

I am guessing that you are looking at data for outside the US or Canada. ROS stands for “rate of sales” which is a velocity measure but not a term usually used here. Can you please use the Contact link (upper left on the blog) to send a message a paste in the table with the numbers and headings you’re asking about? It is hard for me to interpret since the headings and data are not in columns. Thanks!

Hi! thanks a lot for the great post it is really eye-opening. I believe your site is the best in class online resource in the industry.

I am exploring how can I explore further dimensions with the help of TDP.

For one data set, I have calculated TDP per vendor, the AIC & the ROS.

If i divide TDP / AIC this index seems to give me an indication of the average WTD distribution for these items. Is its correct? In the same way if I divide ROS / AIC it could give an average ROS per item. Obviously the analysis is based on aggregates (total SKUs per vendor) but it seems to me it can give a good bench amongst them. Does it sounds right to you?

Thank a lot for your time & consideration!

Gregory

Thanks for the kind words! Glad you are finding the blog helpful. You are correct that if you divide TDP by AIC you get wtd distribution. And, yes, you can calculate ROS (rate of sales, a velocity measure) per item. That would be total sales for the items divided by AIC, which I think is different from dividing ROS by AIC. That result would be too low. Feel free to use the Contact Us form to send a message if you have any further questions.

How about % stores selling –when should that metric be used and how is it different from ACV?

They are similar except that ACV takes into account the relative of stores. So it is better for brand to be available in bigger stores (with more shoppers) than smaller stores. See this post for more info. For some retailers they prefer to see things as a % of stores rather than ACV. That’s fine as long as their stores are all pretty much the same size. If a chain has “small stores” and “large stores,” then %ACV is a better measure since it weights the stores.

I am obviously missing something here but why is %ACV used to calculate TDP? I thought TDP was equal to the number of “points” at which a SKU was available. So if a SKU is available in 300 stores, it would have 300 total distribution points. By comparison I thought %ACV looked at what percentage of the total stores the SKU was available in – so if there are 1,000 stores in which the SKU could be sold but it was only sold (as an active scan, as opposed to merely being offered for sale) in 300, then the SKU would have a 30% ACV but 300 TDP.

TDP (in an IRI/Nielsen/SPINS database or report) is never the number of stores. Some people may use the term “distribution point” casually to mean the number of stores but it has a very specific meaning in one of these databases. If a measure is related to number of stores, it will have the word “stores” in the name. Also, PSS stands for “% of stores.” For the correct definition of TDP, at the SKU level TDP and %ACV are the same thing! Hope this helps.

Hi Sally,

Great article! Could you please help me understand the difference between Wtd Distribution and ACV Wtd Distribution?

Thanks!

Bella, Generally they would be synonymous since ACV Wtd Distribution is the most common distribution measure in the industry. But you could theoretically weight distribution by something other than ACV. So Wtd Distribution would be a more general term than ACV Wtd Distribution. But, again, it’s pretty safe to assume that the “Wtd” refers to ACV Wtd. Sally

The initial set of explanation says that TDPs combine both breadth (% ACV) and depth (number of items sold). But when you calculated TDPs, you added the %ACVs of all items and divided it by %ACV of the entire brand. so where is the number of items coming into play. Both numerator and denominator considers the %number of stores where the items are sold.

Kindly clarify if I am missing anything

TDP = sum of %ACV for all items. You do not divide by %ACV for the entire brand. Sum of %ACV divided by % ACV for the brand = Average Items Carried, a different metric. At one point in the article, Robin mentions that TDP and Average Items Carried can be similar (though you need to move the decimal place) when distribution for the brand is 100% – perhaps that is where your confusion stemmed from.

Off topic, but on topic. If i have differing depth of inventory by location (nodes), and know the percent of orders that are 1, 2, 3, 4,…units per order. Is there a way to calculate my rate of splitting orders between multiple points/nodes? If inv was in only 2 nodes? vs 3 nodes? and so on?

Sorry, I don’t understand your question. Can you provide more details or ask the question another way?

Great article! For a group of UPCs, when comparing to yago, will a negative TDP indicate that distribution has declined and this could be the number of items in that group and/or those items having less distribution?

Exactly right! You need to dig in to find out what’s driving a change in TDP since it could be either/both.

Hello,

This is a great blog – I’ve been in the cpg industry for some time but am only now really using Distribution facts in detail.

I have a question, I know that TDP % chg should be used at the Brand level but when using it at a item level If TDP is in decline but my # of store selling in growing.. Does that mean I lost distribution in some stores but more stores are selling my item? Am I wrong to think that the should both be in decline or growing?

I’m glad you’re finding the blog useful!

It is quite possible for TDPs and number of stores selling to be moving in opposite directions. # of stores is one component of TDP, and usually moves in the same direction as %ACV. The situation you describe (TDP going down but # of stores increasing) can happen when the brand is in more stores but the stores that have been added are selling fewer items. The second part of TDPs is # of items. It is somewhat common for stores that are first taking a brand to start with fewer items and then add more over time.

Hope this helps!

Hi, thanks for the information – I had a question on the prior question from Patrick Beglar:

# of stores is one component of TDP, and usually moves in the same direction as %ACV.

As I understand your definition above, TDP is the sum of the %ACVs, which does not take into account the # of stores. So if I have 4 products selling in 3 out of 4 stores, I have the same TDP as if those 4 products are selling in 300 out of 400 stores (75*4=300) – because the %ACV is the same.

So TDP does not take into account the # of stores placed? What metric would reflect the fact that the latter example is 100x more than the former?

And thank you!

You are correct that TDP is the sum of %ACV for each item. But you can think of %ACV as similar to % of stores but with bigger stores getting more credit. See this post and this one for more detailed explanations that include simple examples comparing %ACV and % of stores. So, yes, technically TDP does not take into account the number of stores but rather the portion or % of stores. And you’re right that being in 3 out of 4 or 300 out of 400 stores would both result in 75% ACV distribution but only IF all the stores (the 4 or the 400 in this example) were the same size, with size being measured as annual ACV dollars. It seems like the metric you are looking for is “# of stores selling.” But that does not take into account the number of items also, like TDP does. Keep in mind that TDP = %ACV at the weekly item level. Please use the Contact function (at the upper right on the blog) if you have further questions and I’d be happy to set up a quick call.

Hope this helps!

If I know for Brand A, our TDP is 319. From that what I will understand?

TDP is pretty meaningless without context. You can’t really say “I know X from a TDP of Y”. It’s most useful to look at changes to TDP over time or compare TDP across brands or markets. When I show TDP in a report or presentation, I rarely show the absolute numbers. I’ll show % change or turn it into an index.

Hi,

It is a great article. Thanks for all the information.

I have one question, can we add the TDPs over different periods?

Suppose, I want to look at the data from a weekly angle as well as a monthly angle. Can I extract the data for all the weeks separately and sum it all together to look at the monthly figure? or is using Max or Avg a better option for TDPs?

Yes, you can add TDP across weeks. You just need to remember that it’s now period specific, just like it would be if you summed dollars or units across weeks. Using an average of TDP is going to give you the same answers as summing it. Taking a Max TDP would also be fine – I have not ever done that but I don’t see why you couldn’t.

Thankyou so much for your quick response, it helps alot.

Hi, I would have a question related to countries with relatively high level of in-outs in total sales. Is TDP still valuable measure in such situations? My understanding is TDP is mostly to understand competitiveness of the brands on shelf (because of that we calculate fair share of shelf). I want to understand above for developed brands with %ACV above 95%

So…a few things here. TDP can be used to get to a share of shelf metric, but that is only a surrogate since it would not account for facings. So if an item has 3 facings on shelf it still only counts one time when looking at average number of items, based on TDPs. With respect to in-and-out items (also called LTO or Limited time Offerings) that are not on shelf all year-round the measure of their true distribution hinges on the time period you’re looking at and if you are looking at Avg ACV or Max ACV (also called ACV Reach). Take a look at this post which gets into more detail on that. For in-and-out items it is probably best to use the Max or Reach ACV, as that tells you the %ACV that the item sold in at all ever during the period. So for a longer period, say 12 weeks for example, if the in-and-out was in 80% ACV for 4 of those weeks the Max or Reach ACV would be 80 for the 12-week period but only 26.7 for Avg ACV (80×4 / 12 weeks). Please feel to use the Contact link to follow up with the specific question your are trying to address and I’d be happy to set up a meeting to discuss further.

Very helpful article!

Let’s say that a brand’s total dollar and unit sales have increased year-over-year. However, their total points of distribution (TDP) have decreased during the same time period. How can a brand achieve those increases in total dollar and unit sales despite lower annual points of distribution? Further, what actions would you recommend to increase total points of distribution for the coming year?

Thank you so much

That pattern is possible when the distribution losses are on marginal items or in marginal stores where sales rates were weak. If growth is strong elsewhere, that growth can overcome the lost distribution.That being said, it would be unusal for a brand to have large distribution losses and still be able to grow dollars and units. I would expect the distribution losses to be small in your scenario.

In terms of actions, the first question would be to hone in on the details of the distribution losses. Which items? Which retailers? Did a retailer discontinue the brand or did several retailers discontinue weak items? Once you know that, you can formulate ideas on how to regain the distribution. It’s also possible that a brand might have made changes in their plan or line that anticipated the distribution loss. For example, the brand might have proactively discontinued a weak flavor in order to consolidate their marketing dollars behind the core items in their line.

Great Article! Do you know if this specific formula is the same equation that IRI uses within their program to calculate TDP?

I believe it is but have seen some data where it doesn’t quite add up. I think the difference is related to the avg vs. max/reach version of the item aggregate in the numerator and the subtotal in the denominator. (See this post.) If you have access to an actual IRI client service person go ahead and ask them…and please let us know what you find out.

Hi,

This is a great article that have help me understand better the meaning of the TDP.

I would like to know if I can aggreagate TDP when I want to join markets, i.e. I want to create a market by joining Total US-MULO and TOTAL US-NATURAL, what will be the proper way to calculate the TDP for a product in the joined market, if I have the TDP for the product at Total US-MULO and TOTAL US-NATURAL?

I’m glad you found this post helpful to you! Unfortunately there’s really no good way to aggregate TDPs across channels like MULO and Natural. The sizes of those channels are SO different – 1 TDP in MULO is orders of magnitude more important than 1 TDP in Natural as the foot traffic and sales are so much higher. I’ve seen (and reported myself) the TDPs separately for MULO and Natural at several CPG clients, usually in the VMS space. If you are ultimately calculating the size of the distribution opportunity in total dollars you should do the calculations at the channel level and can then add the dollar results together to get the total opportunity. Hope this helps!

Can you not calculate TDP as number of doors a brand is in * number of SKUs carried in those doors if you don’t have ACV data?

Taking the number the skus carried in a “door” and adding them up across all doors would certainly be in the spirit of TDP. Any measure where you are factoring in the number of items carried rather than just the presence of any item from the brand would be a proxy for the precise TDP measure. The key is to get depth of distribution as well as reach. I’m not sure aobut the multiplication you are suggesting – I’m not following that – but it might make sense if I saw your actual numbers.