Velocity questions have dominated the CPG Data Tip Sheet inbox this month, with a number of readers posting comments or writing with questions about this important measure. So we decided it’s time to turn our attention to what is, after all, the third most important measure in your database.

Why is velocity the #3 measure? Well, sales is #1 because that’s your bottom line. You wouldn’t buy data if it didn’t include sales. And distribution ranks #2 because you can’t have sales without distribution. Velocity (or “Sales Rate”) ranks third in important because it captures everything other than distribution.

Velocity tells you how well your product sells when it’s available to consumers on the shelf. When you combine velocity and distribution, you get retail sales.

In mathematical terms (and why not do some math? This is data class after all!):

![]()

I’m going to illustrate this concept with the simplest of examples: unit sales in a set number of stores. We don’t recommend using this simplified measure (Units per Store) for real-world analysis, but it’s great for getting a handle on the concept. (I’ll talk about which measures we do recommend later in this post.)

Say there are two brands, both with sales of 3,000 units. But the forces driving their sales differ. Product A has low distribution and high velocity. Product B has excellent distribution but weak velocity, relative to Product A.

The difference between these measures influences the approach you would take to increase sales. Distribution is ultimately under the retailer’s control. So for Product A, you would make a case with the retailer for greater distribution to increase sales. Velocity can reflect a variety of factors, many of which are under the manufacturer’s control. So for Product B, your next step would be to dig in and assess the factors that impact velocity, such as price, promotion, variety or competitive factors, and then prioritize your marketing programs based on your findings.

Choosing the Right Velocity Measure

If you rearrange the sales equation, you can better understand the basic idea behind the many velocity measures in your Nielsen/IRI/SPINS database:

![]() Every velocity measure contains sales in the numerator and distribution in the denominator. The measure you choose will depend on whether you’re comparing across different markets/retailers or are looking within a single market/retailer.

Every velocity measure contains sales in the numerator and distribution in the denominator. The measure you choose will depend on whether you’re comparing across different markets/retailers or are looking within a single market/retailer.

The two major velocity measures are:

- Sales per Point of Distribution (SPPD)

- Sales per Million (Sales per $MM ACV).

Companies occasionally use a third measure, Sales per Store. This is the measure I used in my simple example above. We don’t recommend this measure because it it doesn’t take into account differences in store sizes, which can can create biases in the velocity estimates.

Sales per Point of Distribution (SPPD)

Looking at velocity as Sales per Point of Distribution (SPPD) is the simplest, most intuitive choice for analyzing sales within a single market or single retailer. Also sometimes called “Sales per Point,” this measure is an improvement over Sales per Store because it incorporates store size by using an ACV weighted distribution measure in the denominator. Like all velocity measures, SPPD can be expressed in dollars, units, or volume per point of distribution.

![]()

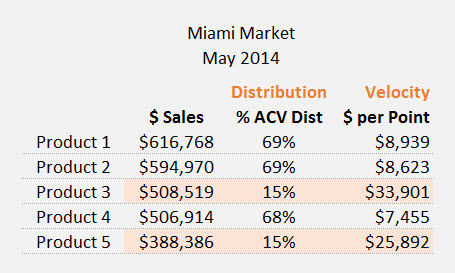

SPPD is commonly seen in ranking reports at the item level for an individual market, as in this example:

By breaking sales into distribution and velocity, we have divided these five products into two groups. One group has strong distribution and poor velocity (Product 1, 2, and 4) and the other group has poor distribution and strong velocity (Products 3 and 5). This is a great starting point for further investigation.

SPPD works at the retailer, market, channel or total U.S. level as long as there is only one market in your analysis. Don’t use SPPD to compare across markets, channels, retailers or to compare a retailer to its remaining market (ROM).

For velocity to matter, you need to have variation in distribution. When distribution is near 100% within a market, velocity and sales rankings will be almost the same, so you can limit your focus to sales. For example, in the table above, Products 1, 2, and 4 all have similar distribution. When we compare these three products, analyzing dollars and velocity will lead us to the same conclusion.

Sales Per Million (Sales Per $MM ACV)

When you’re comparing across markets, SPPD is no longer a helpful measure. Instead, the best velocity measure for comparing across markets is Sales per Million. Sales per Million should be used when comparing a retailer to its remaining market, comparing across metro markets or census regions, and comparing one channel to another.

Why doesn’t SPPD work when you are comparing across markets? Because a point of distribution in a big market will yield more sales than in a small market. For example, distribution in 75% of New York will generate way more sales than 75% distribution in Des Moines. When you’re looking across markets, not only can the % ACV differ but the actual ACV varies too. So you need a velocity measure that reflects actual ACV, not % ACV. That’s what Sales per Million does.

Sales per Million is short for “sales per million dollars of market ACV,” and is calculated with this formula:

Another way to think about it: For every million dollars of total market sales, X amount of my product is sold.

Another way to think about it: For every million dollars of total market sales, X amount of my product is sold.

As you can imagine, market ACV is a really big number, which is why it’s expressed in millions. It just makes it easier to work with.

As with the other velocity measures, Sales per Million can be expressed in units, dollars, or volume.

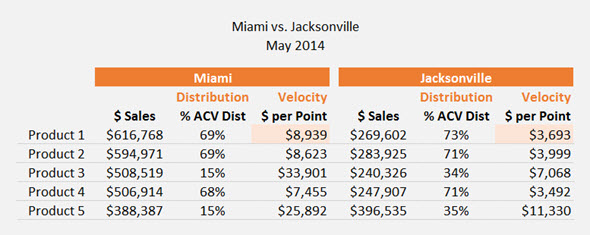

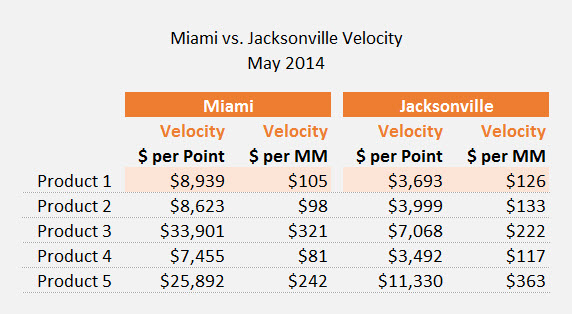

To illustrate, let’s return to our earlier example, but here we want to compare Miami to Jacksonville. Miami is three times the size of Jacksonville. The raw sales numbers reflect that population difference and the velocity numbers do too. For example, look at Product 1: Dollars per Point of Distribution is much lower in Jacksonville than Miami.

So does the lower velocity in Jacksonville reflect weaker consumer demand or just a smaller playing field? To find out, we turn to Dollars per Million, which adjusts for the difference in market size by putting market ACV in the denominator. Now we can see that, controlling for market size, only Product 3 has a better sales rate in Miami. The rest of the items sell better in Jacksonville.

Using Sales per Million is key when comparing velocity across markets. You can also use Sales per Million within a market, instead of SPPD. Some people prefer to use SPPD whenever they can because they find it easier to understand and/or communicate. Other people prefer to use Sales per Million in all their analyses so they are consistent in their velocity measure.

That’s it for today’s velocity class! Here are the top four points to remember:

- The first step in understanding sales is to separate distribution and velocity.

- Velocity is always some measure of sales divided by some measure of distribution.

- When looking within one market (not across markets), you can use either Sales per Point of Distribution (SPPD) or Sales per Million (Sales per $MM ACV).

- When looking across markets, use Sales per Million. Do not use SPPD.

Need help incorporating velocity into your analysis or presenting your sales rate findings to a non-expert audience? Contact us to learn more about our consulting services. We provide analytic support, hands-on analysis, and syndicated data training for individuals and groups.

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles every 2-3 weeks. We will not share your email address with anyone.

Note: Data examples in this post were edited to eliminate reader confusion caused by spreadsheet rounding. SM 2/3/17

Hi – I have both units per point of ACV and dollars per point of ACV in my database. Does it matter which one I use? If I used dollars and my competitor is priced higher, would that show higher velocity for them?

Your choice of velocity measure (dollars or units) follows the same logic as your choice to total sales measure (dollars or units).

When creating a selling story for a retailer, dollars per point of ACV would likely be the better measure to use. Dollar measures are typically the most compelling for that audience.

Manufacturers often prefer to look at unit or volume measures, since they don’t control the retail price. However, I think it’s still helpful to look at dollar measures as well, since it will factor in those competitive price differences and give another view of the bottom line. That same logic would apply to dollar velocity. If you look at both unit sales and dollar sales, you would probably want to look at both velocity measures too. If you never look at dollar sales and you always analyze units, then you want to focus on unit velocity. You would generally line up your velocity measure choice with your total sales measure choice.

If your competitor is priced higher, their dollar velocity might or might not be higher. A higher price does not guarantee higher dollar velocity, just as a higher price doesn’t guarantee higher dollar sales.

Is velocity additive?

No, velocity is not additive. To understand why, it helps to remember that velocity=sales rate. Rates are not additive – to measure the rate of speed of a group of cars, you wouldn’t add their individual speeds together.

To combine velocity measures across products, markets, time, etc. you can either take an average or, if you have the underlying data available, re-calculate the measure for the group. Either tactic should be done with care!

Greeting Sally,

I hope this post finds you well.

You have stated the formula as:

Sales Per Million = Sales / (% ACV * ( Market ACV / 1,000,000))

Can you confirm that %ACV is a required in the denominator for this calculation?

The Nielsen training material I have received states that:

$ Sales Per Million = $ Sales / (Market ACV / 1,000,000)

In other words, it does not include the %ACV in the denominator.

Can you clarify which is correct?

Thanks in advance.

Hi Nestor,

Here’s my conceptual “what does this measure mean” answer: in calculating Sales per Million for a product, the level of distribution for the product must be reflected somewhere in the denominator. The whole point of the measure is to control for distribution.

Why does your training material formula not seem to reflect this? The most likely explanation is a different meaning for the term “Market ACV”. When I used that term, I meant total ACV for the entire market across all products. Nielsen’s “Market ACV” may be product specific and reflect the total ACV for stores that carry that product. If that’s the case, in your Nielsen data, there would be different values for “Market ACV” for each product. If they are using “Market ACV” in the sense that I was, the value for that measure would be the same for every product in the market.

Does that make sense?

Best,

Sally

Hi Sally,

Yes, that makes perfect sense. In fact, that explanation helped me derived the following algebraically.

Assume %ACV = (Σ ACV of Stores Selling) / Total Market ACV

If…

Sales Per Million = Sales / (%ACV * ( Total Market ACV / 1,000,000))

By simple substitution…

Sales Per Million = Sales / ( (Σ ACV of Stores Selling) / Total Market ACV ) * ( Total Market ACV / 1,000,000))

Which means…

Sales Per Million = Sales / ( (Σ ACV of Stores Selling) / 1,000,000 )

Which is exactly what you are saying. In the Nielsen training material, the denominator is a bit ambiguous.

Thanks for the clarification on that one.

I think I have another question/comment about this topic. I need to finish working through it on my end before I post.

Warm Regards,

Nestor

Hi Sally,

I had asked you a question offline about some discrepancies I was encountering while trying to back into the Total Market ACV using Sales Per Million. Your feedback enlightened me, so I wanted to share it with the rest of your readership.

Sally wrote:

“The way I back into total ACV is to divide dollars by dollars per million. To get an accurate number, you have to use item, brand, or category totals that have 100% distribution. I use weekly numbers to do the calculation because 100% distribution weekly is a tougher standard to meet than 100% distribution in a 4 week period. I find that if I do the calculation with different items that all meet this 100% distribution criteria, the ACV number are *very* similar. But still not exactly the same. Within 1% though.”

Thanks for all of your help.

-Nestor

When looking at the brand level for velocity across accout, can I use the SSPD measure? I am looking to find out how accounts differ in velocity with a line of new items we launched last year.

Dear Kimberly,

SSPD is not a good measure to use when comparing across accounts. The sales potential of a point of distribution can vary dramatically across accounts. For example, regardless of the product, a point of distribution is going to deliver more sales at Walmart than Rite Aid, right?

To compare across accounts, the best measure is sales per million dollars of ACV.

You can see why by looking at the chart in the article that compares these two measures for Miami vs. Jacksonville. The same issues will hold true when comparing across accounts.

Now, if the accounts you are comparing happen to have VERY similar levels of ACV, then SPPD and Sales per Million might not look that different. But that’s a rare situation.

Thanks a lot for your clear explanations and useful insight.

In terms of comparing the performance of different variants within a brand, isn’t it the same to use the Share in Handler (or Share in Sellers) custom measure? What more does Velocity has to offer in this case?

If all the items within the retailer (handler, seller) have the same distribution, then yes you can just use share within the retailer. But…that is a big if! It is possible and fairly common for stores within a chain to sell slightly different items of a given brand. Also, keep in mind that an item must actually scan to be considered in distribution so the distribution is often slightly different by item, especially in categories that are typically purchased only a few times a year. Velocity controls for any differences in distribution, even within a chain. If the distribution across items really is the same, then share within the chain will be fine to use.

Hi Sally,

When calculating SPPD, is it ok to use any time frame such as 52wk, 24wk…etc? Also, is it ok to us Avg % ACV? Besides Max % ACV I don’t see any other ACV measure in my SPINS dataset.

Thank you,

Cynthia

Dear Cynthia,

I generally like to use 12 or 13 weeks for SPPD. Conditions can change considerably over a longer period of time. I will also use 4 weeks on occasion though that can be be judged as “too short” just as 52 weeks is “too long”. IMO 12 or 13 weeks tends to be “just right” for making an argument. The exception would be for a very new product where you don’t have a full 12 or 13 weeks of distribution.

Average % ACV is fine. You can also use Max % ACV if you think that’s a fairer measure of a product’s true distribution (if it’s a slower moving product category).

Hi,

I am unable to understand how SPPD values are calculated. In the example you mentioned that Sales for Product A as 616,768 and %ACV as 69%.

Based on the formula provided, SPPD is Sales/%ACV which results in the value 8939. However, in your example the value provided is 8889.

Can you please help me understand where I’m going wrong.

Hi there, You are understanding/doing the calculation correctly. That slight difference is due to rounding – I believe my %ACV numbers originally had one decimal place and I rounded them when I created this graphic. I apologize for the confusion and will make a note to adjust the chart in my post. Best, Sally

I had this same question about the calculation discrepancy, I was going crazy, thank you!

I’ve now edited the charts to resolve this confusion. Thanks again for pointing it out!

Hi Sally

I don’t understand ACV, what does this mean?

Thanks alot

We have an article that should help you understand All About ACV. If you have specific questions after that, please let us know.

We’re trying to set goals for our new retail product (ZestTea.com). We know about how many units we need to sell per month between our SKUs to retain shelf placement (about 5.1 units per month per SKU for tea). After how many months should we aim to get the product up to acceptable sales velocity?

Also, do you have any rules of thumb around how much as a percentage of annual revenue (sales to distributors) should be spent on marketing (promos + demos), to get to full velocity? We are aiming to retain about 40% margins on sales to distributors before promos and OIs.

Good questions but not something I have insight into. I would think the “how long do we have” question would vary by retailer. Sorry not be of more help on this one.

Can you help me better understand Base Velocity.

If Base Velocity has declined vs YA, does that just mean that items are just not moving as fast as they did YA? (when not on promotion)

For example:

Looking at Total Clorox Wipes (4 SKU’s in distribution)

Total Points of distribution (ACV and # items) remained the same vs YA, however Base Sales declined like $20,000 vs YA

Can you better explain how Base Velocity impacts such a large decline if ACV or # items didn’t change?

Base velocity could be impacted by many factors: everyday price changes, attractiveness of the options versus competition, consumer promotion like coupons, changes in level of advertising, changes in what competitors are doing, new products that are stealing sales from you, changes in consumer tastes. So there is a lot there to investigate and much of it can’t be examined through syndicated data. But looking at everyday price and what’s going on with your competitors would be a good place to start.

What is YA?

YA stands for Year Ago

Hi Sally, Thanks for this article super helpful. Question if your $/SPP (Sales/%ACV) YOY is positive and your $/TDP YOY is negative. What does this suggest/mean?

Hi Amit, Are you asking this question about data at the brand level? If so, then the pattern you suggest would occur when you have added varieties or sizes or whatever at the UPC level (so TDP goes up but % ACV for the brand does not) and those new items deliver a a sales rate that is lower than the brand average. This situation would be a classic example of the value of assessing your brand health based on TDP versus %ACV.

Hello

What is the value of Market ACV that you have used for Miami and Jacksonville in the above formula? Do I get in the report that I refer or is it something that I can derive?

Some databases will include that measure. If yours does not, or if you are purchasing reports via Excel, here’s how to calculate it:

How to Estimate Retailer ACV

I have the same question, I can’t see what follows after the colon….

Thanks for calling that to my attention – the link was not showing up. I’ve corrected the original comment to display the link. Again, again, here is the article:

How to Estimate Retailer ACV

Good Afternoon, I’m wondering if you are comparing your product across 2 retailers if it would be better to look at the simple “Units per Store” Measure.

For example,

Product A- Stocked at 50 stores of Haufman’s Produce, Selling 100 Units

Product A – Stocked at 20 stores of Tony’s Grocery, Selling 100 Units

Wouldn’t you be able to easily conclude that your velocity is higher at Tony’s? (based on per store sales)

Thanks!

In your example, you are selling 2 units per store at Haufman’s and 5 units per store at Tony’s. But suppose that each of Tony’s stores are 10 times bigger (in terms of traffic and overall volume sold) than the Haufman’s stores. If you look at your velocity relative to the size of the store, your velocity is actually stronger at Haufman’s. You might expect 10 times the sales per store at Tony’s, given the relative store sizes for the two retailers. That’s the additional information you get by looking at measures like Sales per $MM of ACV. You might undervalue Haufman’s based on Sales per Store. But looking at Sales per Million will show you that Haufman’s is actually a very strong performer relative to its size.

Hi

From the example you provided for SPPD the formula is SPPD= sales / %ACV.

For product 1 it would be $8939 = 616768 / 69

Why do you use 69 if it is a % and not 0.69?

It’s just a convention to divide by the %ACV (but not an actual %). If you divide by 0.69 instead of 69 in the example, then the resulting SPPD would be 100x bigger with many extra digits in the number which is just a little harder to read. Technically you are correct, though.

Looking for the sales index based on the following:

Store units: 10,000

Store ACV $: $25 million

Chain Sales per $MM ACV: 600

Sorry, I don’t understand your question. If you can elaborate more on what you are trying to accomplish, I’ll attempt to help.

Sally,

If you’re ranking across brands in a category is there a way to handle brand size (e.g. large national brands with high sales and distribution) when ranking on a measure like $ per MM? I.e won’t these brands always top your rankings?

Velocity is designed to adjust for changes in distribution. The numerator is sales and the denominator is some measure of distribution so it’s fundamentally sales per level of distribution. Therefore, velocity measures for a national brand will have a higher numerator than a regional brand (because it’s available in more stores) but also a higher denominator (because it’s available in more stores).

However, that being said, one additional issue that arises with measures of brand level velocity is that large national brands typical have more varieties (flavors, sizes, whatever) in distribution as well. They have a broader line so more sku’s contributing to total brand sales. To take account of this, you would need to be taking a look at velocity measures that take number of items into account. One way I’ve done this is to simply divide brand level $/MM velocity by the number of items in the line (essentially yielding average velocity per item). Another way to approach this is to use total points of distribution (TDP or TPD) as the denominator. I’ve written a post about that here.

Hi Sally,

What are some reasons a product would have low distribution but high velocity like Product 3 and 5 in your example?

Nancy,

1) If you are looking at broad geographies, you could see this pattern for smaller/local brands which are very strong within their limited distribution areas.

2) Within a retailer, could see this if they are correctly customizing assortment by store based on shopper demographics.

3) A strong new product that is still rolling out distribution.

Hi there!

I just started at Nielsen working in Bev/Al Industry. I am trying to understand the relationship between $volume, %ACV Distribution, and $Sales per point of distribution. In one example you showed the impact and the why for the relationship between dollar sales, unit sales, and eq volume. Let me know if this question makes sense and if you can help, thank you!!

Sorry, I don’t really understand your question. There is a discussion of $ Sales per Point of Distribution in this post. If you feel that doesn’t sufficiently address the relationship between the numerator and the denominator, and you feel you need something more basic, I suggest you re-read the very first part of this post where I talk about units per store. The same logic applies to $ sales per point of distribution. Just mentally substitute dollars for units and %ACV for stores and perhaps that will help you get a handle on the concept. If you can be more specific about what you don’t understand, then post another comment and I’ll try to help further.

Thanks for your insightful articles. They are always great help in understanding things! Thank you very much!

Hi,

Much appreciate if you could help me to understand the sales per million better.

Let’s take Product 1 in Miami for example, by using your formula I would be getting 616,768/(69*(8,480,979/1,000,000) which equals to $1,054.

However, in your chart it says that the $ per MM for Product 1 in Miami is $105. What am I missing here?

Thank you.

Hi there,

I’m not sure where you got the number 8,480,979? I don’t give you the ACV for the market in my post so you don’t actually have the data you need to calculate $/MM. Questions about calculations have come up a couple of times so I’m going to add an example with all the numbers needed to calculate $/MM to the post. But in the meantime, here is an example for you:

Product A Sales at Retailer X = $28,428

% ACV = 86%

Retailer ACV (across the whole store) = $284,886,762

$ per million = $28,428 / ((86/100)*(284,886,762/1000000)) = $116

Hope this helps clarify!

I’m not able to follow the $ per million calculation from the example either. Where are you getting the Market ACV amount to divide by 1,000,000?

The article doesn’t explicitly show that calculation. I give you the formula and then I compare the $ per million value to the $ per point value. I see that adding the explicit step of showing the $ per million calculation would be helpful and I’ll consider updating the article to include that.

That being said, $ per Million is generally provided as a fact in your database or report from Nielsen/IRI. If it is, you don’t need to calculate it. If it’s not, you frequently won’t have the info you need to calculate it because Market ACV is not commonly reported. It’s a metric that’s available in Nielsen’s subscription databases (I don’t know about IRI) but it’s not something you would get in an ad hoc report from Nielsen/IRI.

I have a way that I back into Market ACV but it requires $ per million to calculate it so that doesn’t help if you don’t have $ per million in the first place! FYI here’s the article on backing into Market ACV calculation using $ and $ per million.

If this isn’t getting at your question, please try again!

Hello- I’m hoping you can explain 2 questions for me, illustrated below, for a client. Any insight would be appreciated!

1) Dollar Sales Per Point of Distribution= How is this # higher vs. PY. if Dollar Sales and ACV Weighted Distribution are both down pretty significantly? Is the best way to explain this that even though both measures are down vs. PY, it’s selling slightly higher in areas where it’s scanning vs. prior year?

2) How is the $ per $MM ACV less this year. vs. PY, if the DSPPD and ACV $MM are both increased this year?

These figures below are for the Latest 4 week period and the geography being used it Total US Food. i don’t know if that affects the answer to these questions or not either, but in case it helps!

Dollar Sales ACV WD DSPPD ACV $MM $ per $MM ACV

Current $2,420,522 70.76 $34,209 $604,809 $5.66

YAG $2,528,911 75.86 $33,337 $584,561 $5.70

vs. YAG -4.3% -5.10 2.6% 3.5% -0.8%

Thank you,

Taryn

1) It’s not uncommon for velocity to go up when distribution goes down. Often when you lose distribution, it’s in places where your sales aren’t as strong. So take out those weaker stores or retailers and your new average velocity is going to be higher.

2) DSPPD and $ per $MM ACV are both measures of velocity but they can yield slightly different conclusions and that happens in this case. DSPDD is up 2.6% and $/MM is down -.8%. It’s not a super radical difference but it is directionally different. Generally, $/MM would be considered a more robust measure of velocity so I would probably go with that one if I had to pick one.

3) You note that ACV $MM is increased but that is the whole trading area. That’s not the denominator for $ per $MM ACV. To get that, you multiply % ACV * ACV $MM.

I’m looking to break down what is driving volume growth: distribution, # of items on shelf, and velocity I think are the core items. (1) Is there an article that helps to identify how to break down volume growth? and (2) What would be the best velocity metric to use that accounts for just velocity increasing on the base UPCs (not UPCs that were added over the time frame)?

There is a series of posts about how to do a Volume Decomposition! Here is the last of the 6 posts, which contains links to the other 5 posts in the series.

Good idea to separate out the impact of velocity of base items, especially if there are several new items and they have not yet reached their full potential if advertising and promotions have not started yet. You’ll see in the Volume Decomp posts that I like to use TDP as the distribution measure and then sales/TDP for velocity. To separate the base item velocity, though, is a matter of limiting what items are included in the product for that, not of using a different velocity measure. I’d be happy to discuss further on a quick phone call. Please use the Contact link on the blog and we can set something up.

Hi – I’ve seen a presentation that shows me a metric $/S/S/W – Can you help me determine how you imagine this was calculated? I understand $ / store / week but do you know what the other S is likely to be?

I’m stumped! Maybe it’s just a typo? Is there anything anywhere else in the presentation that gives you some clues?

It just occurred to me it could be $ per store (the first S) per storeweek (abbreviated S/W). That wouldn’t make sense analytically because you would have number of stores in there twice. I still think typo is most likely!

That’s Dollars per store selling per sku per week. Think of it as the velocity per item

What does it mean if at a specific retailer units per $MM ACV is up +8% vs YA but units per store per week is down -5%? It’s for a large retailer and large brand. Does it mean velocity improved in stores with smaller distribution? Could this drive UPSPW down but units per $MM ACV up? Any other potential cause?

The pattern you describe can happen if a retailer is losing overall sales ($ACV is declining) but your brand is declining less than average. It works the other way too. If sales for your brand are growing, leading to higher units per store, you can still see declines in U per $MM ACV if total store sales are gaining at an even faster rate.

Your website has been a lifesaver for me. Thank you!

I am trying to understand what is going on in a category. Over the past 5 years I have seen the following at the xAOC level:

2016: baseline

2017: $ sales down, Unit sales down, TDP down, %ACV up, velocity ($/TDP) up, base unit price up

2018: $ sales down, unit sales down, TDP down, %ACV down, velocity up, base unit price down

2019: $ sales up, unit sales down, TDP down, %ACV down, velocity up, base unit price down

2020: $ sales up, unit sales down, TDP down, %ACV up, velocity up, base unit price up

2017 and 2018 make sense: TDP and Sales down together

2019: Sales are up even though TDP and unit sales are down. Just because the velocity has gone up? Units sold and base price down but sales go up???

2020: again, $ sales are up with another drop in TDP and units sold.

I really have no idea what to look into next to determine what is causing. The average # items has fallen every year as well.

Glad you are finding the CPG Data Tip Sheet useful! So…there are lots of things going on here. Let’s put 2020 aside for now, since relationships between business drivers have been very different than what would be expected due to changes in shopper (and retailer) behavior starting in mid-March. Here are several posts that should help you sort this out:

– This one explains how dollar sales and unit sales can be moving in different directions

– This post explains the relationship between TDP, %ACV and AIC. You should look at either TDPs alone OR %ACV and AIC. Also, velocity typically does increase when distribution goes down since it’s usually the slower-moving items that lose distribution and/or the less successful stores (for that item) that drop the item.

– I recommend looking at average price, instead of base price. Take a look at this post and you’ll see why. Regarding your question related what’s happening in 2019, if base price (or average price) is up you would expect unit sales to go down. What happens to dollar sales depends on the price elasticity.

– Velocity depends on distribution, price, merchandising and other things so that shouldn’t really be included. At a high level you can see if changes are due to distribution OR velocity and then if it’s velocity is it it due to pricing, merchandising, something else?

– Finally, there is a series of 6 posts related to how do a volume decomposition which allocates changes in volume to different drivers. Here’s a link to the overview of those and you can to all 6 from that one.

Hope this helps!

Hello Robin/Sally,

Thank you for the post, it was an insightful read. In my role I am currently using only the velocity that you mentioned at the beginning of your post (sales/distribution). Our case is that we have several clothing stores of different size that carry various different categories of products. The stores vary somewhat in capacity.

I’m trying to find a better way to analyze which products are doing well in a certain period and which ones we should focus on and your idea of SPPD caught my eye. However, I’m not sure it is the right KPI for my situation.

Would you be able to give me any guidance on this?

Thanks kindly,

Ardi

It’s good to see readers applying analysis from the CPG world to other domains – like apparel. And it sounds like you work at a retailer, not a manufacturer. How many stores are there? If it’s a few dozen than this might work: using your internal POS data, rank the items by sales within each store. See if there’s a pattern as to which products do better (or worse) across stores. Here’s another thought: For each store, calculate the average product’s sales and then index all products to the average for that store, then do the ranking. When you say you’re trying to figure out which products to “focus on,” what does that mean? Is this related to optimizing assortment or doing a promotion plan? I’d be happy to discuss further – contact me using the Contact link at the top of the page and I can schedule a 30-minute call.

Hello Robin/Sally! I really appreciate your website, everything is incredibly insightful and helpful.

If 2 products within the same market have the same distribution but different SPPD, can I reasonably say that the product with a higher SPPD has stronger velocities? Or can we not compare since the distribution levels are the same?

Also, can I compare a brand’s SPPD versus the average of numerous brands’ SPPD? Or can I only compare at a product level?

Just trying to understand how I can use SPPD to compare versus competitors, as stronger velocities can help with a retailer buy-in story.

Thanks!

Thanks for the kind words – we’re glad you are finding the blog useful! (I think when you say “product” you are talking about individual items, right?) Yes, you can absolutely compare the velocity of items in the same geography using SPPD to say one is moving faster than the other. You can also compare a brand’s velocity to an average of all the brands’ velocities. I’m not sure what you’re using for the denominator in your calculation – %ACV or TDPs. You could use either one but sales per TDP is really the better measure (unless your brand has “too many” items, which would decrease the sales per TDP relative to other brands).

Velocity is definitely the most compelling measure when presenting to retailers!