Here’s a recent question we received from a CPG Data Insights reader:

“I know that ACV is not additive, but is there a way to calculate total ACV for a Brand when you have 5 UPCs with ACV measure? Can you average the ACV of the 5 UPCs for total Brand ACV?”

Before I answer the question, let me answer another question that some of you may have: Why would somebody ask this? For many small companies or ones that are getting syndicated for the first time, they are likely to purchase ad hoc reports in Excel, rather than getting access to an on-going database. The most common ad hoc report is an item ranking report. This gives the manufacturer an idea of what items and competitors are in their category and the relative performance. Retailers will sometimes require that manufacturers selling in new items show them item velocity data and recommend which existing items the new items should replace on the shelf. And…an item ranking report only has item level data in it, plus a category total. Brand totals are not in an item ranking report, even though it is very useful. You can always sum up individual items to get to brand sales but distribution measures are not additive, so you need way to estimate brand level distribution.

So back to the original question: The short answer is No, you should not average the ACV of items to get total Brand ACV. (Let’s assume that the reader means % ACV here, which is extremely likely.) Read this post as a reminder on ACV.

While you can take the average of the individual items, that would understate the Brand ACV. Remember that a brand gets credit for being in distribution in a geography for a period if:

- at least 1 item in the brand scans in

- at least 1 store in the geography in

- at least 1 week in the period.

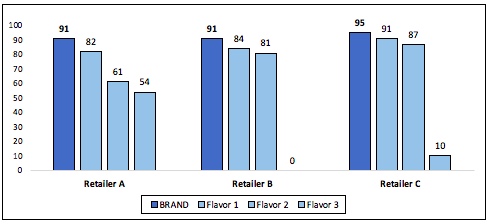

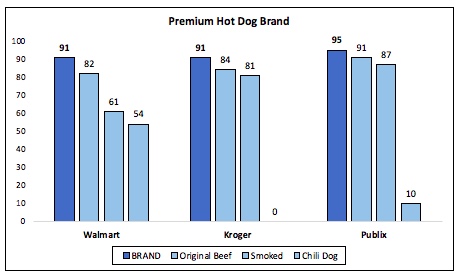

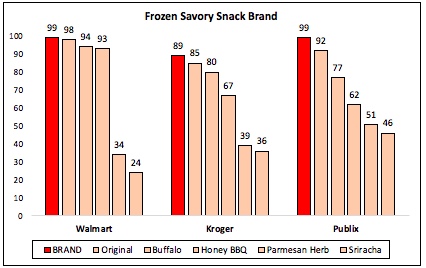

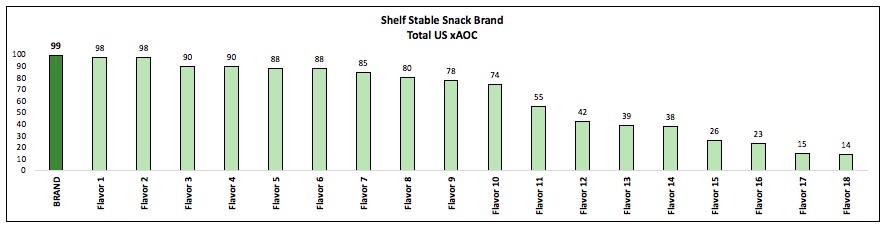

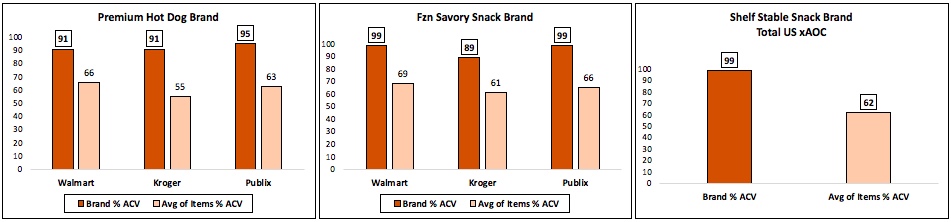

So…Brand distribution is always at least as high as the item with the highest distribution and usually higher than that. Take a look at these real-life (but masked) examples of Brand and Item % ACV Distribution for 3 different brands. Notice that the Brand % ACV is higher than any of the individual items for all 3 brands in different geographies.

% ACV Distribution

12 weeks ending 5/20/18

When you calculate the average % ACV of the items within a brand it will always be something less than the maximum % ACV among the items. That’s just how the math works!

So…what should you use as the Brand % ACV? Here are 2 options:

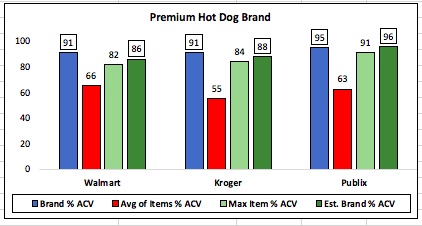

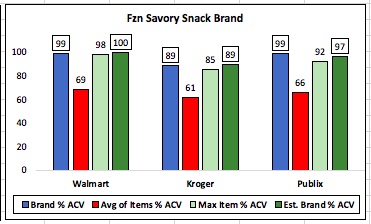

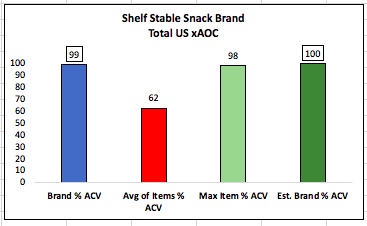

- Assume the Brand %ACV is the same as the %ACV for the max item

This is the most conservative assumption but works well if there is a clear “lead” item. In the above examples, you would be pretty darn close for the Frozen Savory Snack brand in Walmart and the Shelf Stable Snack brand in Total US xAOC – 98 vs. 99 in both cases. The 2 examples highlighted above both have Original flavors, which are almost aways carried so it’s OK to use the % ACV for those lead items. - More accurate assumption

If you want to be more accurate, I recommend adding about 5% (not 5 points) to the max item and calling that the brand distribution. And if that results in a number over 100, then the estimated Brand distribution is 100. So, for the Hot Dog brand in Walmart above, a good estimate for Brand % ACV is 86 (= 82 * 1.05). Even though this is less than the true Brand ACV of 91, it’s a lot closer than the average of the 3 items, which is 66.

Here are those results for our example brands:

In summary…the best way to estimate brand level distribution if you only have item level data is to increase the distribution of the item with the highest value a little without going over 100%. (I recommend adding 5%.) Unfortunately there is not a simple way to automate this for all brands in an item ranking report but it’s a straightforward way to estimate brand distribution for your brand and some key competitors.

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles once a month (or even less frequently). We will not share your email address with anyone.

Another informative and practical article, Robin. You and Sally really do a great job with this blog!

Hi Robin,

Can I check if I can use the same method on PCV wtd dist? Thanks! 🙂

I think the answer is yes, but…please clarify what PCV means. What does the P stand for? When I worked at Kraft Foods, we had a measure “AKV” which stands for All Kraft Volume, instead of All Commodity Volume. So %AKV was a measure of distribution weighted by importance to the total Kraft business, not total store business.