For a quick refresher on which time periods you can get on your database, see this previous post: Timing is Everything, Part I.

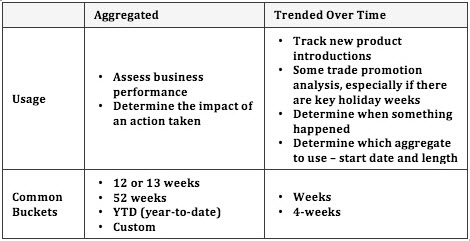

Given all the possible time periods that you may have access to, it is important to first determine what business question you are trying to answer. There are 2 ways to think about periods: aggregated or trended.

If you are assessing overall business performance or are trying to quantify the impact of an action that was taken, then you should use an aggregate time period and compare performance vs. that same period a year ago. That’s the most straightforward way to see a snapshot in time of what is happening. To get an idea of recent performance, the most common aggregates used are 12 (or 13) weeks. It can be misleading to just look at one month or 4-week period to assess overall business performance due to the possible impact of shifting trade events. 52 weeks is a good period to use when trying to understand longer-term performance, but you may want to also look at trended results over a long period. That will let you see if the 52-week change has been consistent over time. Look at YTD (year-to-date) to compare results to your company’s plan for the fiscal year.

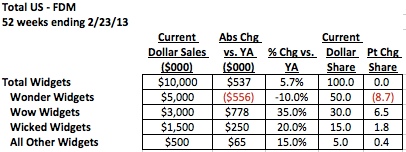

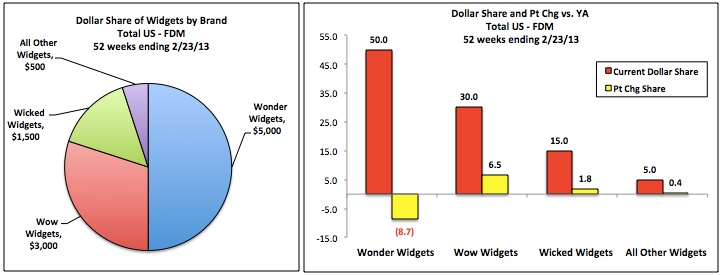

While it is often sufficient to just look at the numbers in a table to understand what is happening in an aggregate period, creating some graphs can help put things in better perspective.

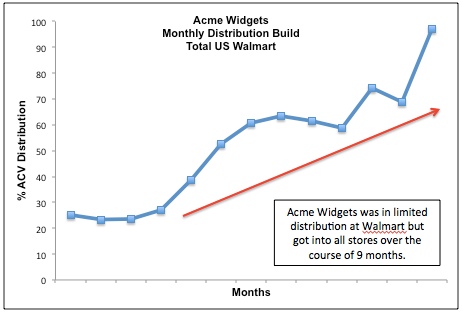

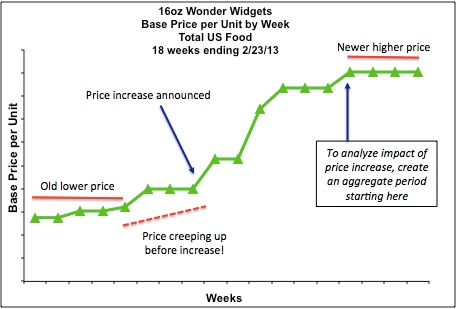

If you want to track new product performance (yours or a competitor’s), analyze trade promotions (especially when there are specific key weeks) or determine when a specific thing happened in the market (retail price change, competitive entry, flow-through of new package size, etc.), then you should look at trended periods. It is most common to look at trended individual weeks or 4-week periods.

Look for future posts on CPG Data Tip Sheet with specific examples of analyses using aggregate or trended periods.

If you enjoyed this article, subscribe to future posts via email. We won’t share your email address with anyone.

Thanks for a really clear and coherent explanation of these concepts!

I’m sorry, but I still don’t understand the difference between aggregate and trended. Rather than discussing when you would use them, could you please discuss how they are calculated and what they are?

An aggregate 13 week value is calculated from the individual 13 weeks that make up that quarter. A 13 week aggregate for dollar sales would be the sum of the individual 13 weeks of sales. A 13 week aggregate for distribution would be the average of the distribution for those 13 individual weeks. So how the aggregate is calculated depends on which metric – sometimes it’s the sum of the individual weeks and sometimes it’s the average of the individual weeks.

You might want to look at the aggregate value for 13 weeks (the sum of the 13 weeks or the average of the 13 weeks expressed as 1 value) or you might want to look at the trended individual weeks (in other words see all 13 individual values).

Does that make it clearer?